Introduction

Ever feel like you’re navigating a maze when it comes to money matters? Well, fear not, because Tony Robbins is here to be your guiding light through the murky waters of finance.

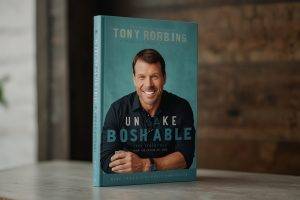

In his groundbreaking book, “Unshakeable,” Robbins unveils the keys to unlocking lasting prosperity and security in an ever-changing world.

So, if you’re ready to ditch the stress and uncertainty and embrace a future of abundance, then join me as we delve into the transformative insights of his book “Unshakeable.”

Tony Robbins “Unshakeable”: Overview of the Book’s Main Premise

“Unshakeable” by Tony Robbins is your essential guide to financial freedom.

Robbins distills complex financial concepts into practical strategies, empowering his readers to navigate the ever-changing landscape of investing with confidence.

The book emphasizes the importance of understanding the psychology of wealth and building a resilient investment portfolio. With insights into market volatility and the power of compound interest, “Unshakeable” equips you to weather any financial storm and emerge stronger on the other side.

Whether you’re a seasoned investor or just starting, Robbins’ timeless wisdom provides a roadmap to achieving lasting financial security and peace of mind.

Key Concepts and Principles Covered in the Book

Ready to unlock your financial freedom? Dive into “Unshakeable” by Tony Robbins.

Here are 7 key concepts and principles covered in the book that will transform your approach to investing:

- Financial Freedom Blueprint: “Unshakeable” serves as a blueprint for achieving financial freedom, providing practical strategies to navigate the complexities of investing with confidence.

- Psychology of Wealth: Robbins delves into the psychology of wealth, helping readers understand and overcome common behavioral biases that can hinder financial success.

- Resilient Investing: The book emphasizes building a resilient investment portfolio, focusing on asset allocation and diversification to minimize risk and maximize returns. Those who are planning to invest in various stocks but don’t know where and how to start may use an mt4 automated trading robot. If you want to expand your investment, you can read gold articles and how they can help you diversify your portfolio. Understanding market trends and the historical value of gold can provide you with insights into making informed decisions that align with your financial goals. If you want to seek investment opportunities overseas, like in Portugal, you may be eligible to apply for citizenship through portugal citizenship by investment programs.

- Navigating Market Volatility: Robbins offers insights into navigating market volatility, teaching readers how to stay calm and focused during turbulent times and capitalize on opportunities.

- Compound Interest: “Unshakeable” highlights the power of compound interest, demonstrating how even small investments can grow exponentially over time.

- Setting Realistic Goals: Readers are guided through the process of setting realistic financial goals and developing a personalized investment plan tailored to their needs.

- Long-Term Perspective: Throughout the book, Robbins encourages a long-term perspective on investing, emphasizing the importance of staying the course and resisting the urge to react impulsively to short-term market fluctuations.

Now, let’s also have a look at some of the psychology of investing principles covered in Tony Robbins’s book Unshakeable.

Behavioral Finance Principles Discussed in the Book

Here are the fascinating behavioral finance principles uncovered in Tony Robbins’s book “Unshakeable”, revealing why we sometimes act irrationally when it comes to money and investments:

- Loss Aversion: Robbins explores how humans tend to feel the pain of losses more acutely than the pleasure of gains, leading to irrational decision-making.

- Herding Behavior: The book delves into the tendency of individuals to follow the crowd, even if it means deviating from rational investment strategies.

- Overconfidence Bias: Robbins discusses how overestimating one’s abilities can lead to excessive risk-taking and suboptimal investment decisions.

- Anchoring: The book highlights how humans often rely too heavily on initial information or “anchors” when making investment decisions, even in the face of new evidence.

- Confirmation Bias: Robbins addresses the tendency to seek out information that confirms pre-existing beliefs while ignoring contradictory evidence, leading to biased decision-making.

- Recency Bias: The book explores how individuals tend to overweight recent events when making investment decisions, often to the detriment of long-term financial goals.

Common Biases and Pitfalls in Investing

Let’s also uncover the common biases and pitfalls covered in the book that can trip up even the savviest investors:

- Fear of Missing Out (FOMO): Robbins discusses how the fear of missing out on potential gains can drive investors to make impulsive and irrational decisions.

- Herd Mentality: The book highlights the danger of following the crowd without conducting proper research, which can lead to herd-driven market bubbles and subsequent crashes.

- Overtrading: Robbins addresses the tendency of investors to trade too frequently, often in response to short-term market fluctuations, resulting in unnecessary transaction costs and reduced returns.

- Emotional Investing: The book warns against making investment decisions based on emotions such as fear or greed, which can cloud judgment and lead to poor outcomes.

- Ignoring Risk: Robbins emphasizes the importance of considering risk factors in investment decisions and cautions against chasing high returns without proper risk assessment.

- Market Timing: The book discusses the pitfalls of trying to time the market, highlighting research that shows the difficulty of consistently predicting market movements.

Now, let’s also explore some of the strategies covered in the book for overcoming psychological barriers to achieve financial success…

Strategies for Overcoming Psychological Barriers to Financial Success

Ready to conquer your inner investor demons? “Tony Robbins Unshakeable” equips you with practical strategies to overcome psychological barriers to financial success, empowering you to make sound decisions with confidence.

These strategies include:

- Education and Awareness: Robbins advocates for educating yourself about common biases and pitfalls in investing to become more aware of their impact on your decision-making.

- Developing Discipline: The book emphasizes the importance of maintaining discipline and sticking to a well-thought-out investment plan, even in the face of market volatility.

- Seeking Contrarian Perspectives: Robbins encourages investors to seek out contrarian viewpoints and diverse opinions to avoid falling victim to herd mentality.

- Long-Term Focus: The book promotes a long-term perspective on investing, reminding readers to focus on their financial goals rather than short-term market fluctuations.

- Utilizing Investment Rules and Guidelines: Tony Robbins suggests adopting investment rules and guidelines to help mitigate the influence of emotional biases and promote rational decision-making.

- Seeking Professional Advice: The book recommends seeking advice from qualified financial professionals who can provide objective guidance and help you stay on track toward your financial goals.

The Bottom Line

So, there you have it! “Unshakeable” isn’t just a book; it’s a blueprint for living your best life.

With Tony Robbins as your guide, you’ll embark on a journey of empowerment, enlightenment, and endless possibilities.

So what are you waiting for? Dive into “Unshakeable” today and start building the life of your dreams!